Got 1095 problems but your ERP system ain’t one…

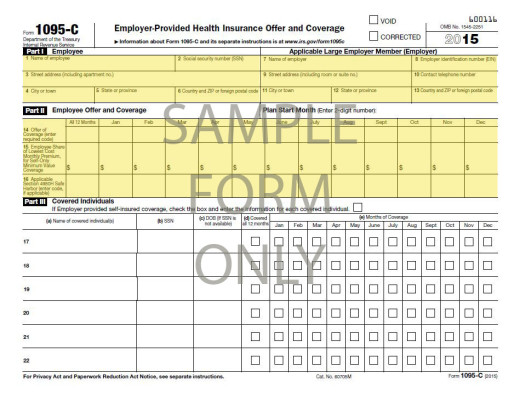

The Affordable Care Act (ACA) has changed the way individuals and businesses integrate healthcare into their operations. For the first time this year, a business that is considered an Applicable Large Employer will be adding the 1095-C to their list of duties at year-end. The 1095-C form is a result of the ACA that essentially tells the employee and the IRS whether health insurance coverage was offered, when it was offered, who it was offered to, and/or why it wasn’t offered. It also indicates what the employee share was of the lowest cost monthly premium for self-only minimum value coverage.

From selecting which employees are subjected to the 1095-C form to tracking how many forms your company is filing (250 or more require an electronic submission), the burden of this workforce reporting can bog down your entire year-end process. To stay ahead of ACA reporting, instigate data collection at the beginning of the year. In the case of reports due in 2016, employee and healthcare tracking should have begun in January 2015. The 1095-C alters the definition of what constitutes full-time as its switches from ‘hours of work’ to ‘hours of service’. As of January 2015, any paid hours of work, such as jury duty, vacation pay, and holiday pay, apply towards the ‘hours of service’ calculation by the ACA.

The 1095-C form requires monthly data. This increase in reporting is a breeze for Carillon® ERP users because the ERP software is already able to provide 1095-C reporting which has been fully integrated into the core ERP system, as all of our enhancements are. Because we are able to limit the number of external add-ons, our clients see a more streamlined process without the complications.

In Carillon® ERP, the 1095-C forms are auto-populated to save you time. If you are an ALE, having at least 50 forms to fill out, the personal information being automated is almost a necessity. Employee and employer information (lines 1-6 and 7-13) are populated for each individual and company. The ‘Offer of Coverage Code’, ‘Employee Share of Lowest Cost Monthly Premium”, and ‘Applicable Section 4980H Safe Harbor Code’ (lines 14, 15 and 16, respectively) are each set to a default that YOU define. The entirety of form 1095-C Sections I and II can be filled out and edited, if necessary, in a single window within Carillon® ERP for every employee. It’s then immediately available on the Employee Portal of Carillon ERP’s WebPack feature.

If your ERP system isn’t ready for the 1095-C, you may by putting your business in danger of hefty federally mandated penalties. Reasons to be fined can range from a failure to complete ACA reporting to offering health insurance that does not meet ACA standards. For example, if you have 100 full-time or full-time equivalent employees and you fail to timely file form 1095-C, you are facing over $25,000 in penalties. Carillon® ERP can automate your 1095-C experience and expedite the submission process, saving you time, money, and most of all, peace of mind.

Pursuant to requirements related to practice before the Internal Revenue Service, any tax advice contained in this communication (including any attachments) is not intended to be used, and cannot be used, for purposes of (i) avoiding penalties imposed under the United States Internal Revenue Code or (ii) promoting, marketing, or recommending to another person any tax-related matter.