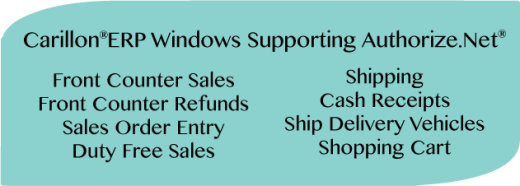

Carillon®ERP and our team of talented developers have been working towards the next great integration for Carillon®ERP users. We are happy to announce our partnership with Authorize.Net ® to provide you with a faster, more accurate method of getting paid!

What is Authorize.Net®?

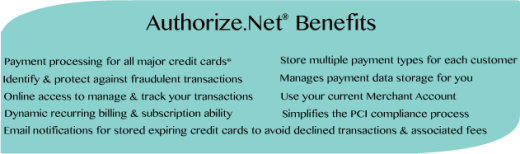

Authorize.Net® is the gateway solution for processing payments. They supply the tools you need to create a successful customer/merchant interaction and provide a reliable method of security and fraud protection.

Thanks to Authorize.Net® and their ability to simplify the PCI compliance process, Carillon®ERP users can accept all major credit cards* and digital payment solutions without ever leaving the Carillon window.

How do credit cards payments work?

The method behind credit card payments can typically be broken down in to three steps.

First, at the register or online shopping cart screen, the customer swipes their credit card or clicks ‘submit’ to begin the purchase of their order. This swipe or submit is the authorization that tells the merchant there are enough customer funds available for this purchase. For example, if I have a $700 limit on my credit card and I want to buy a vacuum for $200, the authorization step ensures I haven’t already spent more than $500 elsewhere and the $200 is available to be used in the purchase of the vacuum.

Next, the funds are ‘captured’. Meaning the funds are put on hold and allocated to that merchant for the purchase. To continue our example above, the merchant can now be sure they will receive payment and can give me the vacuum. The ‘capture’ step has made sure that the $200 will be held for the merchant, in return for me obtaining the vacuum. These first two steps can happen very quickly.

Finally, the merchant bank and customer bank will transfer the money due during the ‘settlement’ step. Banks use the payment network to ‘talk’, and in our example, the bank of the credit card that I used would settle the transaction with the merchant’s bank by moving $200 into the merchant account.

What else can Carillon®ERP’s Payment Processing feature do for me?

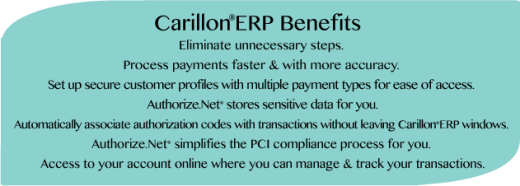

Our Payment Processing Feature will give you the ability to set up secure customer profiles with each customer having multiple payment types available for ease of access. Because Authorize.Net® stores the sensitive data for you, there is no need to keep credit card or other payment numbers on your Carillon®ERP system. Included in the management of your transactions is the capability to associate authorization codes with transactions which adds to your management of your business accounts.

At any time, you can access your online account to track or manage your transactions. The Payment Processing Feature also increases your protection against fraudulent transactions by identifying risks through the many protection filters available with Authorize.Net®. Carillon®ERP users can stop these transactions from ever happening, reducing costs associated with authorization and chargeback fees. Because you can use your current merchant bank, implementation is a breeze.

Recurring and subscription-based billing can be streamlined, set up to be dynamic, and even notify you via email when credit cards, digital payment solutions, or the subscriptions are about to expire. The automation of recurring billing can save you time and eliminate error-prone manual processes.

What does this mean for Carillon®ERP users?

It means you can have a faster payment processing procedure that is more accurate and more convenient. The ability to reduce the number of steps you are doing, and allowing you to stay within one window in Carillon®ERP helps you improve your customer loyalty by advancing their customer experience into a simple yet inclusive method. On top of this, you are protecting your company from fraudulent transactions and the fees associated with rectifying those situations. The ability to use Authorize.Net® as your sensitive data storage facility simplifies the whole process and removes you from the risk of data uncertainty.

We, at Carillon®ERP are dedicated to our goal of helping your business streamline its pursuits in an effort to grow.

Our Payment Processing Feature can provide the next step in your company’s forward momentum.

Call 1.800.739.9933 ext. 129 today!